Dear Journalist,

Prologis Research is pleased to introduce a new proprietary metric: Prologis True Months of Supply (TMS™), as well as to report on Q1 Industrial Business Indicator (IBI) Activity Index. TMS describes the precise interplay of supply and demand. The Prologis IBI is a proprietary monthly diffusion index derived from three components: the business activity index, the space utilization index and the actual rate of space being utilized.

Prologis True Months of Supply

Prologis True Months of Supply (TMS) correlates to real estate leasing conditions.

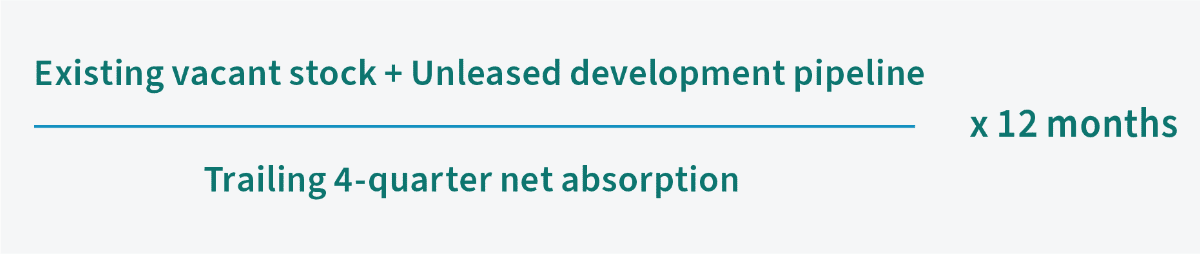

This proprietary measurement accurately captures supply/demand dynamics by comparing all vacant spaces (existing + unleased development pipeline) to trailing net absorption. Traditionally, months of supply for logistics real estate is calculated as the total development pipeline vs. net absorption. However, this can send inaccurate signals in markets with very low vacancy (and low trailing net absorption). TMS corrects for this disparity.

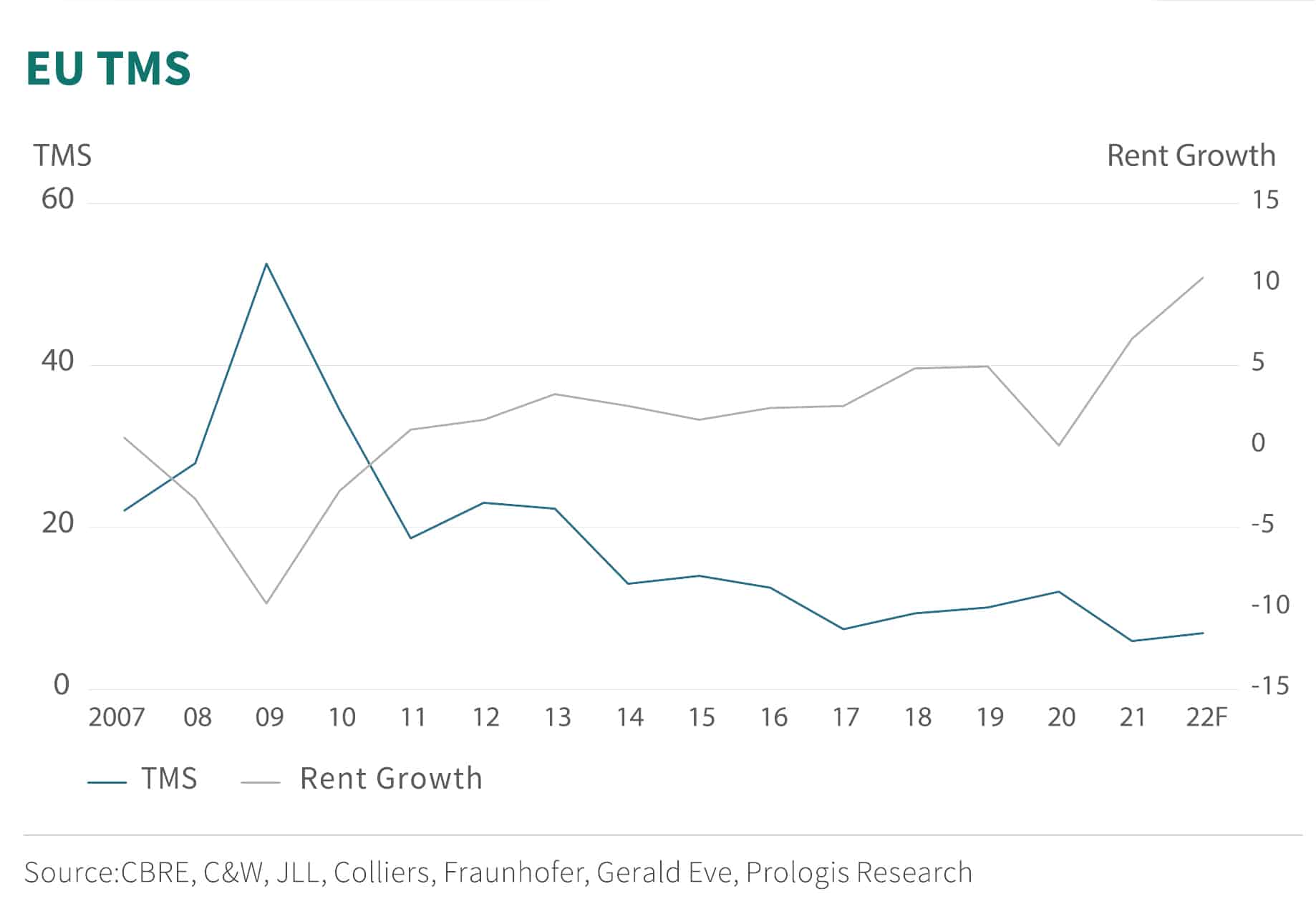

TMS in Europe is at a record low of six months. Europe tends to have a lower TMS than the U.S. due to a higher proportion of build-to-suit developments in the pipeline and newer logistics inventory with fewer obsolete vacancies. TMS has a high correlation (-0.9) with market rent growth since 2007.

“This new metric provides a good indication of potential rent trajectory. In Europe, TMS is at record low of 6 months which is 10 months below the U.S. Over time, this difference narrowed but remains relatively wide. As characteristics of markets differ, TMS differs as well, with one of the main reasons being a higher build-to-suit (BTS) share in the development pipeline. Last year approximately 60% was BTS compared to 15% in the U.S. These are extremely interesting findings,” – Dirk Sosef, Vice President Research & Strategy

Q1 Industrial Business Indicator Index:

Prologis’ IBI™ Activity Index was high across our 29 U.S. markets in Q1 2022, at 65 (> 50 indicates growth). This activity reflects a stronger flow of goods and the “catch-up” race by logistics users to secure limited space.

Select IBI takeaways:

- Competition for space led to record Q1 rent growth. Rents increased by 8.5 percent quarter-over-quarter.i

- Healthy consumer spending and supply chain volatility boosted demand for logistics real estate, yet low supply reduced absorption. Logistics customers absorbed 88 million square feet (MSF) in Q1, down from about 120 MSF in the prior quarter.ii iii

- Materials shortages are fueling this scarcity. New supply in Q1 was lower than expected, at 68 MSF. The vacancy rate fell 20 basis points from the prior quarter to a record low of 3.2 percent.

IBI Deeper Dive:

- Consumer spending and the rebuilding of inventories supported another quarter of solid demand for logistics real estate.

- The flow of goods has opened as supply chain bottlenecks ease.

- At the current rate, available logistics space in the U.S. would dry up in 16 months.

- Ongoing supply chain disruptions will put downward pressure on logistics real estate deliveries.

- Vacancies will remain at record lows through year end.

Watch the full Research Webinar

Endnotes

i Prologis Research

ii CBRE, JLL, Cushman & Wakefield, Colliers, CoStar, CBRE-EA, Prologis Research.

iii Our historical and forecasted stock, net absorption, completions, under construction, and vacancy fundamentals now represent a narrowed 30 markets to reflect where Prologis has a presence.